Personal Finance is the aspect of how to manage our money properly and put it to work for us. The concept of personal finance is extremely wide which ranges right from leveraging your skills to maximize your earning potential and then to saving and finally to investing it adequately. Some of the important building blocks of personal finance include Planning, budgeting, investing, tax planning, retirement planning, etc.

The year 2020-2021 has taught us a lot about how to take care of our personal finances. The importance of managing our money properly. Finance is no longer just a subject, but has become an integral part of our lives.

Why is Personal Finance important?

The role of Personal finance is very crucial in every individual’s life to become financially strong. By practicing the basics of personal finance and following the fundamentals of saving, budgeting, and investing, you will impact your life positively, and that will propel you towards financial prosperity.

Unfortunately, this topic is not taught in school, which makes most of us financially impaired till a very significant age. Due to this, financial stress is extremely common among adults.

Therefore learning about personal finance and managing your finances properly will not only lead to a stress-free but also happy and cheerful life.

Personal Finance trends in 2022

Similar to the technological changes in almost every industry, the personal finance industry has witnessed a lot of changes in the last couple of years. The pandemic has not only helped us realize the importance of our health but also our finances.

Individuals have started to realize the importance of financial planning and the role of investing. They also realized the importance of Insurance and an emergency fund.

Apart from this, there are multiple aspects that were altered in the last year, let’s try to decode some of them.

Here are some of the key trends that have picked up in 2021-2022

-

Increased retail participation in the stock markets

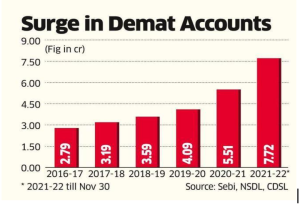

Earlier, investors typically selected mutual funds and other safer instruments such as F.D, Government bonds, etc for investments. But in the last couple of years, the exponential growth of new Demat accounts indicate that retail investors are getting more aggressive with their investments.

The AUM (Asset Under Management) of mutual funds has also increased multifold which depicts the increasing interest of investors towards equity and other equity-related products. Equity as an asset class has outperformed any other asset class in the last couple of years. This led to more and more investors getting attracted to this instrument. Therefore, you should look into this asset class if you aim to achieve higher growth in the long-run.

-

Importance of Gold in your portfolio

Gold has always been a hedge against inflation and also an asset that performs well during times of economic uncertainty and distress. The year 2019-2020 was an example of how gold outperforms the stock markets at times of crisis. Similarly, in the event of a war or at times of other unforeseen situations when equity markets tank. Gold is typically seen to deliver positive returns. Because of this trait, it is also called a safe haven among investors. Therefore, it is advisable to allocate 5 to 10% of your portfolio to gold as a hedge against a stock market decline.

-

Asset allocation and Diversification

Asset allocation is not only beneficial to safeguard your investments but also helps you to carry out informed financial decisions at times of a crisis. Let’s take the year 2021 when stocks outperformed other asset classes like Debt. But what if the stock market does not provide any positive return in the upcoming year?

If you have started investing recently, then it is unwise to put all your capital into stocks. By doing this you are not only taking a higher risk but also undertaking huge volatility. To stabilize this, it is important to diversify your holding into multiple asset classes which will reduce the overall risk and also help you achieve your financial goals stress-free.

-

Importance of an Emergency fund

Having an emergency fund might seem overkill, but this will actually come in handy when there’s a sudden financial emergency. An emergency fund acts as insurance to your ongoing investments, in times of financial distress. Otherwise, you would have to redeem some of your investments at the current market value. To prevent such a scenario, you should have an emergency fund of a minimum of 5-10 times your monthly income. This will give a sufficient buffer, in the scenario of a loss of employment, urgent need of money, etc.

-

Using derivatives to hedge your portfolio

Once you have adhered to the above-mentioned points and put together a sizable portfolio. The next step is to protect it from the increasing market volatility. Derivative instruments such as Futures & Options are extremely effective tools when it comes to hedging your portfolio. Options strategies like ‘Covered Call’, ‘Bull Put Spreads’, etc allow you to generate additional income even in a sideways market. Although Options are high risk instruments and require a lot of skills and experience. With the appropriate approach and hedge, you can earn additional income from the stock markets.

Bottom Line

Inculcating the following financial habits will make you a smart investor and will help you to achieve all your financial goals. Your goals and needs might keep changing with the change in your age and income. Therefore, remember to stay consistent in investing and monitor your finances regularly so that you stay on track to achieve financial stability.

Having said that, managing your finances should not be treated as just a task, but should be made into a habit so that you build your financial health and gain peace of mind.